RM Infrastructure Income PLC

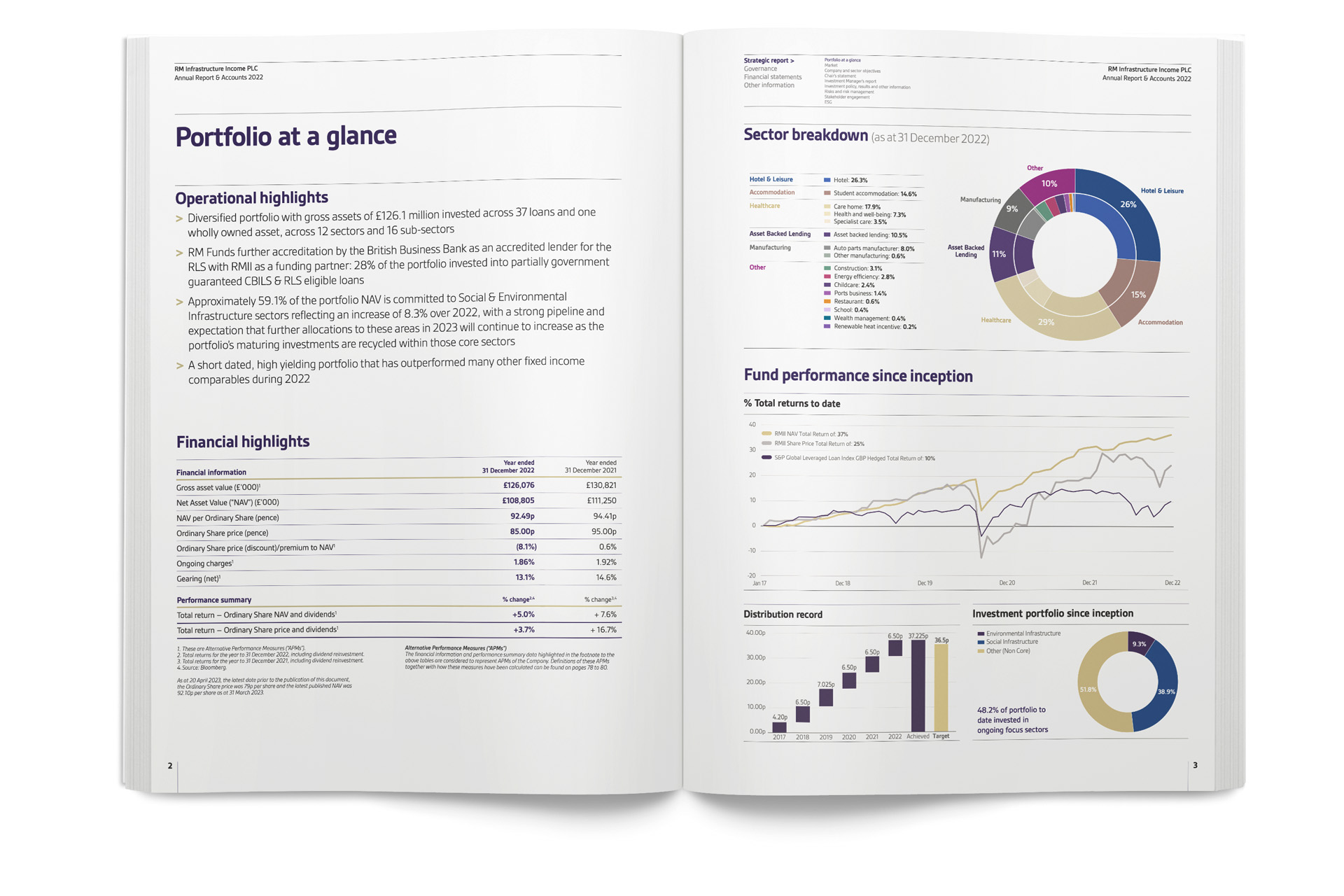

Conveying a refocused strategy and sustainable investing

WHO

RM Infrastructure Income is an investment business that holds loans for 35+ UK businesses across a range of sectors to a total value of more than £130 million. The company aims to generate attractive and regular dividends for shareholders through investment in debt instruments which are backed by real assets, led by exceptional management teams and which usually demonstrate high cash flow visibility.

CHALLENGE

FourthQuarter worked with RM Infrastructure Income on the company’s Annual Report & Accounts 2021, a publication that needed to clearly express the focus and outcomes of a strategic review, which was conducted in the context of the Coronavirus pandemic. The review assessed the resilience of the Company’s target annual dividend of 6.5 pence per share; how to regain a share price that valued the Company above Net Asset Value; how to fulfil the obligations of being a signatory to the UN Principles for Responsible Investment; and the investment portfolio required to achieve all these aims.

SOLUTION

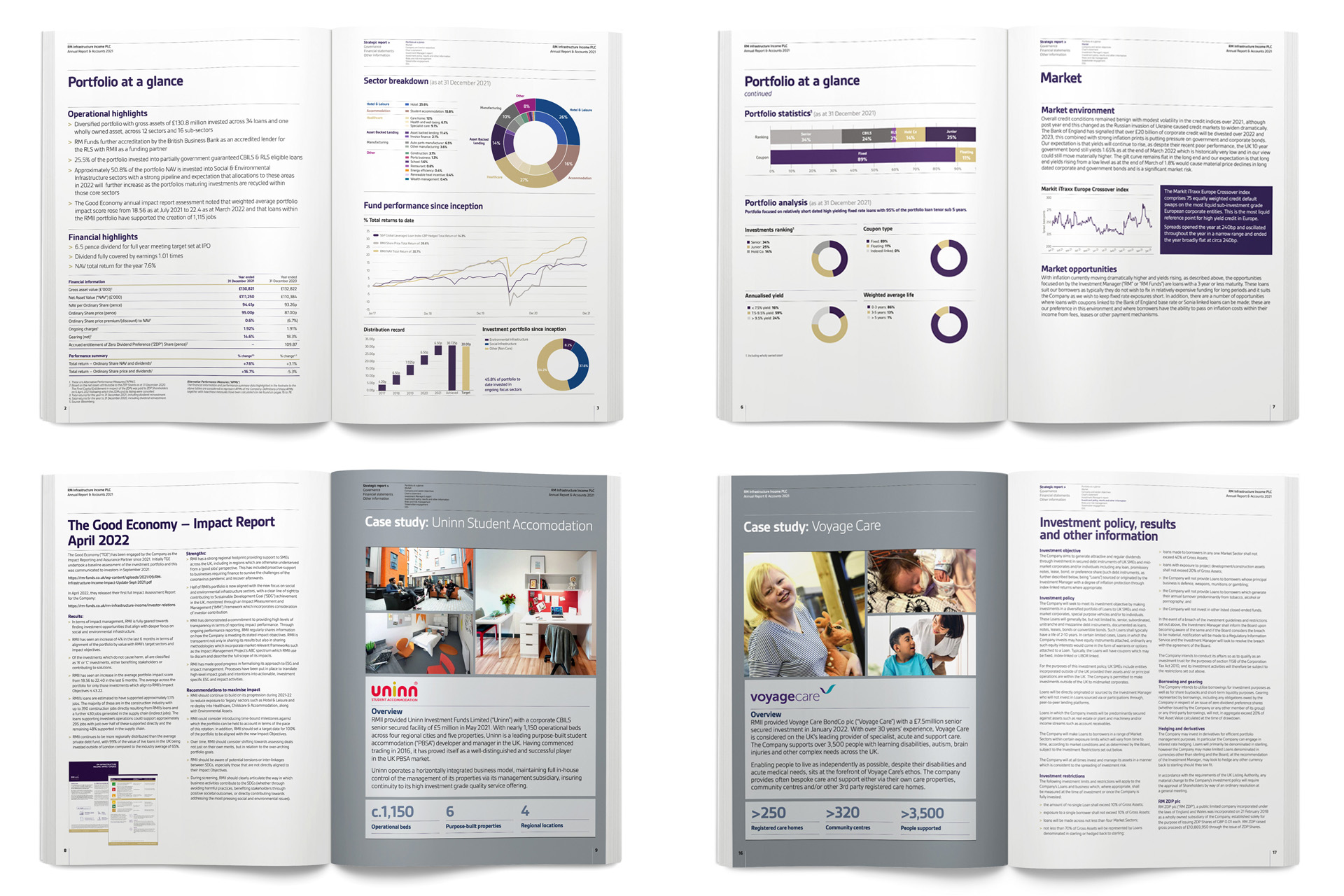

RM Infrastructure Income developed a pivot in strategy which became the dominant story of the 2020 Report. For the next three years the Company would concentrate its investment on social and environmental infrastructure and choose companies to invest in that made a meaningful contribution towards social and environmental outcomes. FourthQuarter ensured the upgraded commitment to responsible investing was communicated from the front cover onwards with a “new horizon” front cover image, a revised document structure and by bringing all key performance indicators to the fore through charts and graphs, not previously utilised.

IMPACT

The key was helping investors to understand how enhancing the sustainability of the portfolio also brought benefits to them. Case studies in particular helped to reinforce this message. They demonstrated how RM Infrastructure Income’s new focus gives investors further exposure to critical infrastructure assets which are not correlated to the broader economic cycle, making them attractive investments.